Meezan Bank Easy Home 2025 – Complete Details under Mera Ghar Mera Ashiana Scheme

Meezan Bank Easy Home 2025

Introduction: Making Home Ownership Easy in Pakistan

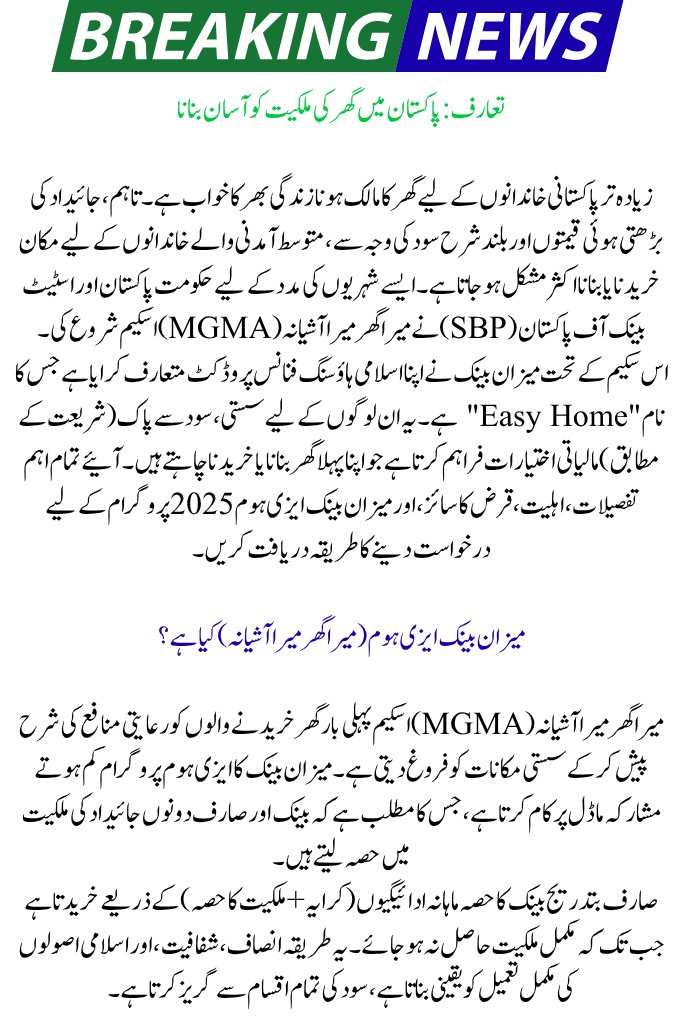

Owning a home is a lifelong dream for most Pakistani families. However, due to rising property prices and high interest rates, it often becomes difficult for middle-income families to buy or build a house. To help such citizens, the Government of Pakistan and the State Bank of Pakistan (SBP) launched the Mera Ghar Mera Ashiana (MGMA) Scheme.

You can read more: Benazir Kafalat Program 2025 Rs. 36,000 New Installment Update

Under this scheme, Meezan Bank has introduced its Islamic housing finance product called “Easy Home.” It provides affordable, interest-free (Shariah-compliant) financing options for people who want to build or purchase their first home. Let’s explore all the important details, eligibility, loan size, and how to apply for the Meezan Bank Easy Home 2025 program.

What is Meezan Bank Easy Home (Mera Ghar Mera Ashiana)?

The Mera Ghar Mera Ashiana (MGMA) scheme promotes affordable housing by offering subsidized profit rates to first-time homebuyers. Meezan Bank’s Easy Home program operates on the Diminishing Musharakah model, which means both the bank and the customer share ownership of the property.

You can read more: CM Punjab Flood Relief Card 2025 – Door-to-Door Survey and Rs. 20,000 Monthly Payment for Flood-Affected Families

The customer gradually buys the bank’s share through monthly payments (rent + ownership portion) until full ownership is achieved. This method ensures fairness, transparency, and full compliance with Islamic principles, avoiding all forms of interest (riba).

Eligibility Criteria for Meezan Bank Easy Home 2025

To apply for Meezan Easy Home under the Mera Ghar Mera Ashiana scheme, applicants must meet certain requirements:

Basic Eligibility Conditions Mera Ghar Mera Ashiana Scheme

- Must be a Pakistani citizen with a valid CNIC.

- The applicant must be a first-time homebuyer.

- Age: Between 20 and 65 years (or retirement age at maturity).

- Must have a verifiable income (either salaried or self-employed).

- Property size:

- House up to 5 Marla, or

- Flat up to 1,360 sq. ft.

- Down payment: Minimum 10% of property value.

- Co-applicants (spouse or family member) can apply together to increase financing eligibility.

This program mainly supports low- and middle-income families, ensuring real buyers benefit instead of investors.

Loan Amount, Tenure, and Profit Rates

| Tier | Loan Limit | Profit Rate (First 10 Years) | Financing Tenure |

|---|---|---|---|

| Tier 1 | Up to PKR 2 million | Fixed 5% per annum | Up to 20 years |

| Tier 2 | PKR 2 million – PKR 3.5 million | Fixed 8% per annum | Up to 20 years |

For the first 10 years, the profit rate remains fixed as per government subsidy. After that, it becomes variable according to market rates (KIBOR + margin). The long repayment tenure helps reduce monthly installments, making homeownership easier and more affordable.

Step-by-Step Application Process

Meezan Bank has made the process simple and transparent. Follow these steps carefully to apply successfully:

How to Apply for Meezan Easy Home Mera Ghar Mera Ashiana Scheme

- Visit the nearest Meezan Bank branch that offers Easy Home financing.

- Request the Mera Ghar Mera Ashiana application form.

- Fill the form with your personal, financial, and property details.

- Submit required documents (listed below).

- Bank verification: Your income, credit history (e-CIB), and property documents are verified.

- Approval and agreement: Once approved, you sign the Diminishing Musharakah agreement.

- Disbursement: The bank pays directly to the seller or builder.

- Monthly payments: You pay rent and purchase installments until you fully own the home.

The complete process usually takes 15–25 working days, depending on verification speed and document accuracy.

You can read more: Punjab E-Taxi Scheme 2025: Check Name in Balloting List Using CNIC & Full Installment Plan Details

Documents Required for Meezan Bank Easy Home

Before applying, keep the following documents ready:

Required Documents Mera Ghar Mera Ashiana Scheme

- CNIC of applicant and co-applicant (if any)

- Two recent passport-size photographs

- Proof of income (salary slip, tax return, or business documents)

- Employment certificate (for salaried applicants)

- Bank statements of last 6–12 months

- Property documents (sale deed, map, title chain, Fard, NOC)

- Recent utility bill (as address proof)

- Nominee details and authorization for direct debit

Important Tips

- Ensure documents are complete and valid.

- Avoid fake or expired records.

- Maintain a good credit history before applying.

- Cross-check all property papers before submission.

Key Benefits of Meezan Bank Easy Home

1. Financial Benefits Mera Ghar Mera Ashiana Scheme

- Low profit rate: 5% or 8% fixed for the first 10 years.

- Flexible repayment: Up to 20 years.

- Small down payment: Only 10% required.

- Government risk coverage: Up to 10% for banks.

2. Shariah and Convenience Benefits Mera Ghar Mera Ashiana Scheme

- 100% Shariah-compliant under the Diminishing Musharakah model.

- No interest (riba) involved.

- Early buy-out option to shorten loan period.

- Available at Meezan Bank branches nationwide.

Example of Monthly Installments Mera Ghar Mera Ashiana Scheme

| Tier | Loan Amount | Profit Rate | Tenure | Approx. Monthly Installment |

|---|---|---|---|---|

| Tier 1 | PKR 2,000,000 | 5% fixed | 20 years | PKR 13,200 |

| Tier 2 | PKR 3,500,000 | 8% fixed | 20 years | PKR 29,400 |

(These figures are approximate and can vary depending on KIBOR and repayment period.)

Common Mistakes to Avoid Mera Ghar Mera Ashiana Scheme

Many applicants face rejection due to simple errors. To ensure smooth approval:

- Don’t submit incomplete or fake documents.

- Make sure your proof of income is verifiable.

- Confirm that your property is within the scheme’s limits.

- Always make on-time payments after loan approval.

Being careful at every step increases your chances of approval and helps you become a homeowner faster.

Final Words

The Meezan Bank Easy Home 2025 under the Mera Ghar Mera Ashiana scheme is an excellent opportunity for Pakistanis to own a home on easy and Islamic terms. With low profit rates, flexible repayment, and Shariah compliance, this scheme ensures comfort and peace of mind for first-time buyers.

If you plan to buy or build a home, visit your nearest Meezan Bank branch today, collect all the details, and start your application confidently.

You can read more: Ehsaas Humqadam Program Registration Latest Update 2026

FAQs Mera Ghar Mera Ashiana Scheme

1. Who is eligible for Meezan Bank Easy Home 2025?

Any Pakistani citizen aged between 20 and 65 years, with a valid CNIC, a steady income source, and no existing home ownership, can apply.

2. What is the maximum financing limit under this scheme?

Meezan Bank offers financing up to PKR 3.5 million under the Mera Ghar Mera Ashiana Scheme.

3. Is this financing Shariah-compliant?

Yes, Meezan Bank Easy Home follows the Diminishing Musharakah model, which is fully Shariah-compliant and interest-free.